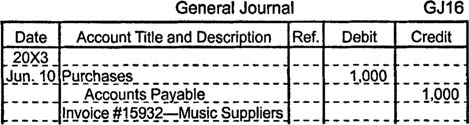

Under the periodic system, a temporary expense account named merchandise purchases, or simply purchases, is used to record the purchase of goods intended for resale. The source documents used to journalize merchandise purchases include the seller's invoice, the company's purchase order, and a receiving report that verifies the accuracy of the inventory quantities. When Music World receives a shipment of merchandise worth $1,000 on account from Music Suppliers, Inc., Music World increases (debits) the purchases account for $1,000 and increases (credits) accounts payable for $1,000.

For reference purposes, the journal entry's description usually includes the invoice number.

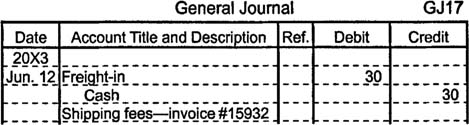

When a seller pays to ship merchandise to a purchaser, the seller records the cost as a delivery expense, which is considered an operating expense and, more specifically, a selling expense. When a purchaser pays the shipping fees, the purchaser considers the fees to be part of the cost of the merchandise. Instead of recording such fees directly in the purchases account, however, they are recorded in a separate expense account named freight‐in or transportation‐in, which provides management with a way to monitor these shipping costs.

If Music World pays a shipping company $30 for delivering the merchandise from Music Suppliers, Inc., Music World increases (debits) freight‐in for $30 and decreases (credits) cash for $30.

![]()

Freight terms, which indicate whether the purchaser or seller pays the shipping fees, are often specified with the abbreviations FOB shipping point or FOB destination. FOB means free on board. FOB shipping point means the purchaser pays the shipping fees and gains title to the merchandise at the shipping point (the seller's place of business). FOB destination means the seller pays the shipping fees and maintains title until the merchandise reaches its destination (the purchaser's place of business).