Sales invoices are source documents that provide a record for each sale. For control purposes, sales invoices should be sequentially prenumbered to help the accounting department determine the disposition of every invoice. Sales revenues equal the selling price of all products that are sold. In accordance with the revenue recognition principle, sales revenue is recognized when a customer receives title to the merchandise, regardless of when the money changes hands. If a customer purchases merchandise at a sales counter and takes possession of the goods immediately, the sales invoice or cash register receipt is the only source document needed to record the sale. However, if merchandise is shipped to the customer, a delivery record or shipping document is matched with the invoice to prove that the merchandise has been shipped to the customer.

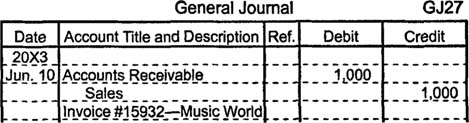

Suppose a company named Music Suppliers, Inc., sells merchandise worth $1,000 on account to a retail store named Music World. Music Suppliers, Inc., records the sale with the journal entry below.

For reference purposes, the journal entry's description often includes the invoice number.