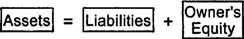

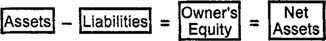

The ability to read financial statements requires an understanding of the items they include and the standard categories used to classify these items. The accounting equation identifies the relationship between the elements of accounting.

Assets. An asset is something of value the company owns. Assets can be tangible or intangible. Tangible assets are generally divided into three major categories: current assets (including cash, marketable securities, accounts receivable, inventory, and prepaid expenses); property, plant, and equipment; and long‐term investments. Intangible assets lack physical substance, but they may, nevertheless, provide substantial value to the company that owns them. Examples of intangible assets include patents, copyrights, trademarks, and franchise licenses. A brief description of some tangible assets follows.

-

Current assets typically include cash and assets the company reasonably expects to use, sell, or collect within one year. Current assets appear on the balance sheet (and in the numbered list below) in order, from most liquid to least liquid. Liquid assets are readily convertible into cash or other assets, and they are generally accepted as payment for liabilities.

-

Cash includes cash on hand (petty cash), bank balances (checking, savings, or money-market accounts), and cash equivalents. Cash equivalents are highly liquid investments, such as certificates of deposit and U.S. treasury bills, with maturities of ninety days or less at the time of purchase.

-

Marketable securities include short-term investments in stocks, bonds (debt), certificates of deposit, or other securities. These items are classified as marketable securities—rather than long-term investments—only if the company has both the ability and the desire to sell them within one year.

-

Accounts receivable are amounts owed to the company by customers who have received products or services but have not yet paid for them.

-

Inventory is the cost to acquire or manufacture merchandise for sale to customers. Although service enterprises that never provide customers with merchandise do not use this category for current assets, inventory usually represents a significant portion of assets in merchandising and manufacturing companies.

-

Prepaid expenses are amounts paid by the company to purchase items or services that represent future costs of doing business. Examples include office supplies, insurance premiums, and advance payments for rent. These assets become expenses as they expire or get used up.

-

Property, plant, and equipment is the title given to long-lived assets the business uses to help generate revenue. This category is sometimes called fixed assets. Examples include land, natural resources such as timber or mineral reserves, buildings, production equipment, vehicles, and office furniture. With the exception of land, the cost of an asset in this category is allocated to expense over the asset's estimated useful life.

-

Long-term investments include purchases of debt or stock issued by other companies and investments with other companies in joint ventures. Long-term investments differ from marketable securities because the company intends to hold long-term investments for more than one year or the securities are not marketable.

Liabilities. Liabilities are the company's existing debts and obligations owed to third parties. Examples include amounts owed to suppliers for goods or services received (accounts payable), to employees for work performed (wages payable), and to banks for principal and interest on loans (notes payable and interest payable). Liabilities are generally classified as short‐term (current) if they are due in one year or less. Long‐term liabilities are not due for at least one year.

Owner's equity. Owner's equity represents the amount owed to the owner or owners by the company. Algebraically, this amount is calculated by subtracting liabilities from each side of the accounting equation. Owner's equity also represents the net assets of the company.

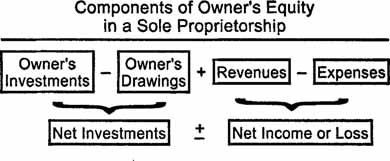

In a sole proprietorship or partnership, owner's equity equals the total net investment in the business plus the net income or loss generated during the business's life. Net investment equals the sum of all investment in the business by the owner or owners minus withdrawals made by the owner or owners. The owner's investment is recorded in the owner's capital account, and any withdrawals are recorded in a separate owner's drawing account. For example, if a business owner contributes $10,000 to start a company but later withdraws $1,000 for personal expenses, the owner's net investment equals $9,000. Net income or net loss equals the company's revenues less its expenses. Revenues are inflows of money or other assets received from customers in exchange for goods or services. Expenses are the costs incurred to generate those revenues.

Capital investments and revenues increase owner's equity, while expenses and owner withdrawals (drawings) decrease owner's equity. In a partnership, there are separate capital and drawing accounts for each partner.

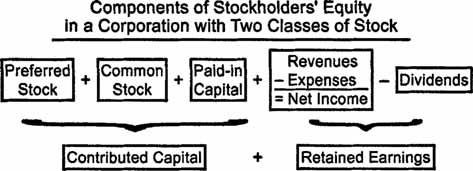

Stockholders' equity. In a corporation, ownership is represented by shares of stock, so the owners' equity. is called stockholders' equity or shareholders' equity. Corporations use several types of accounts to record stockholders' equity activities: preferred stock, common stock, paid‐in capital (these are often referred to as contributed capital), and retained earnings. Contributed capital accounts record the total amount invested by stockholders in the corporation. If a corporation issues more than one class of stock, separate accounts are maintained for each class. Retained earnings equal net income or loss over the life of the business less any amounts given back to stockholders in the form of dividends. Dividends affect stockholders' equity in the same way that owner withdrawals affect owner's equity in sole proprietorships and partnerships.