The Adjustment Process Illustrated

Accountants prepare a trial balance both before and after making adjusting entries. Reexamine the Greener Landscape Group's unadjusted trial balance for April 30, 20X2.

|

Account

|

Debit

|

Credit

|

|

100

|

Cash

|

$ 6,355

|

|

|

110

|

Accounts Receivable

|

150

|

|

|

140

|

Supplies

|

50

|

|

|

145

|

Prepaid Insurance

|

1,200

|

|

|

150

|

Equipment

|

3,000

|

|

|

155

|

Vehicles

|

15,000

|

|

|

200

|

Accounts Payable

|

|

$ 50

|

|

250

|

Unearned Revenue

|

|

270

|

|

280

|

Notes Payable

|

|

10,000

|

|

300

|

J. Green, Capital

|

|

15,000

|

|

350

|

J. Green, Drawing

|

50

|

|

|

400

|

Lawn Cutting Revenue

|

|

750

|

|

500

|

Wages Expense

|

200

|

|

|

510

|

Gas Expense

|

30

|

|

|

520

|

Advertising Expense

|

35

|

|

|

|

$26,070

|

$26,070

|

Consider eight adjusting entries recorded in Mr. Green's general journal and posted to his general ledger accounts. Then, see the adjusted trial balance, which shows the balance of all accounts after the adjusting entries are journalized and posted to the general ledger accounts.

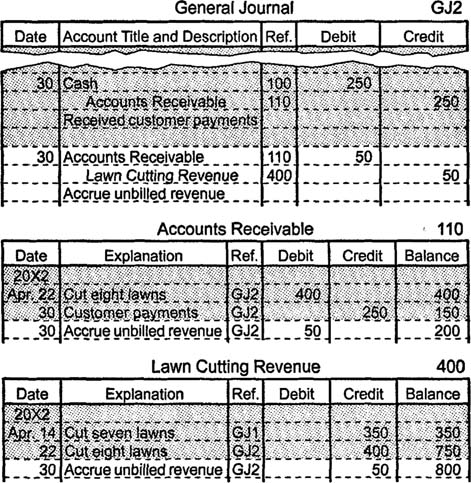

Adjustment A: During the afternoon of April 30, Mr. Green cuts one lawn, and he agrees to mail the customer a bill for $50, which he does on May 2. In accordance with the revenue recognition principle, Mr. Green makes an adjusting entry in April to increase (debit) accounts receivable for $50 and to increase (credit) lawn cutting revenue for $50.

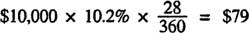

Adjustment B: Mr. Green's $10,000 note payable, which he signed on April 2, carries a 10.2% interest rate. Interest calculations usually exclude the day that loans occur and include the day that loans are paid off. Therefore, Mr. Green uses the formula below to calculate how much interest expense accrued during the final twenty‐eight days of April.

Since the matching principle requires that expenses be reported in the accounting period to which they apply, Mr. Green makes an adjusting entry to increase (debit) interest expense for $79 and to increase (credit) interest payable for $79.

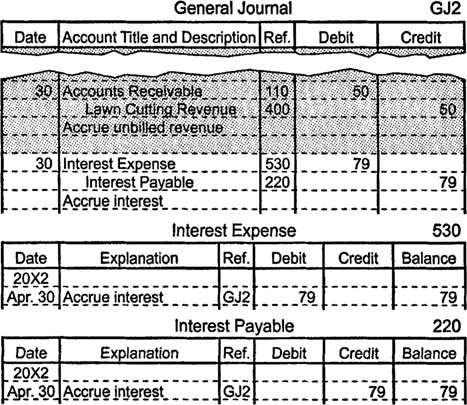

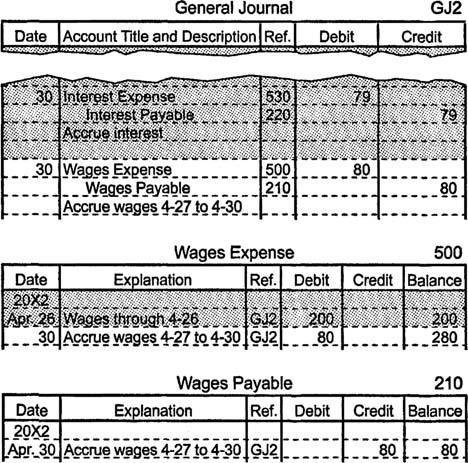

Adjustment C: Mr. Green's part‐time employee earns $80 during the last four days of April but will not be paid until May 10. This requires an adjusting entry that increases (debits) wages expense for $80 and that increases (credits) wages payable for $80.

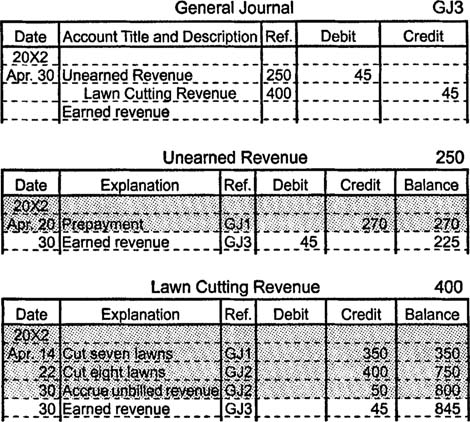

Adjustment D: On April 20 Mr. Green received a $270 prepayment for six future visits. Assuming Mr. Green completed one of these visits in April, he must make a $45 adjusting entry to decrease (debit) unearned revenue and to increase (credit) lawn cutting revenue.

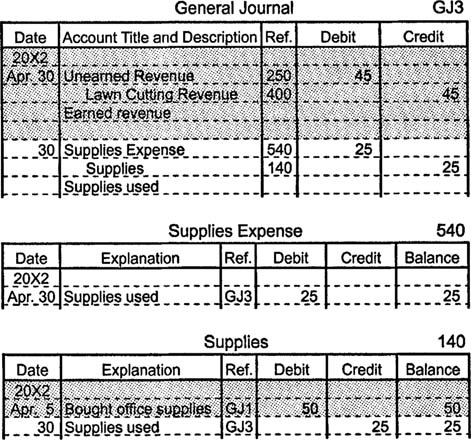

Adjustment E: Mr. Green discovers that he used $25 worth of office supplies during April. He therefore makes a $25 adjusting entry to increase (debit) supplies expense and to decrease (credit) supplies.

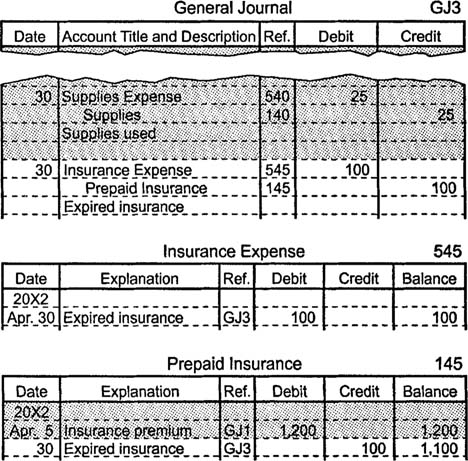

Adjustment F: Mr. Green must record the expiration of one twelfth of his company's insurance policy. Since the annual premium is $1,200, he makes a $100 adjusting entry to increase (debit) insurance expense and to decrease (credit) prepaid insurance.

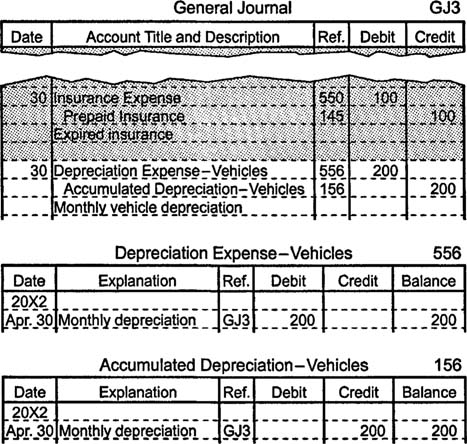

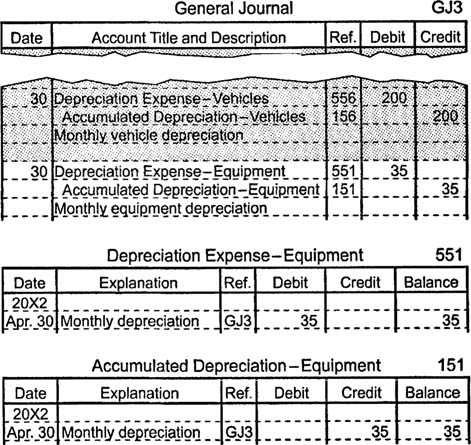

Adjustment G: If depreciation expense on Mr. Green's $15,000 truck is $200 each month, he makes a $200 adjusting entry to increase (debit) an expense account (depreciation expense–vehicles) and to increase (credit) a contra‐asset account (accumulated depreciation–vehicles).

The truck's net book value is now $14,800, which is calculated by subtracting the $200 credit balance in the accumulated depreciation–vehicles account from the $15,000 debit balance in the vehicles account. Many accountants calculate the depreciation of long‐lived assets to the nearest month. Had Mr. Green purchased the truck on April 16 or later, he might not make this adjusting entry until the end of May.

Adjustment H: If depreciation expense on Mr. Green's equipment is $35 each month, he makes a $35 adjusting entry to increase (debit) depreciation expense–equipment and to increase (credit) accumulated depreciation–equipment.

After journalizing and posting all of the adjusting entries, Mr. Green prepares an adjusted trial balance. The Greener Landscape Group's adjusted trial balance for April 30,20X2 appears below.

The Greener Landscape Group Adjusted Trial Balance April 30,20X2

|

Account

|

Debit

|

Credit

|

|

100

|

Cash

|

$ 6,355

|

|

|

110

|

Accounts Receivable

|

200

|

|

|

140

|

Supplies

|

25

|

|

|

145

|

Prepaid Insurance

|

1,100

|

|

|

150

|

Equipment

|

3,000

|

|

|

151

|

Accumulated Depreciation–Equipment

|

|

$ 35

|

|

155

|

Vehicles

|

15,000

|

|

|

156

|

Accumulated Depreciation–Vehicles

|

|

200

|

|

200

|

Accounts Payable

|

|

50

|

|

210

|

Wages Payable

|

|

80

|

|

220

|

Interest Payable

|

|

79

|

|

250

|

Unearned Revenue

|

|

225

|

|

280

|

Notes Payable

|

|

10,000

|

|

300

|

J. Green, Capital

|

|

15,000

|

|

350

|

J. Green, Drawing

|

50

|

|

|

400

|

Lawn Cutting Revenue

|

|

845

|

|

500

|

Wages Expense

|

280

|

|

|

510

|

Gas Expense

|

30

|

|

|

520

|

Advertising Expense

|

35

|

|

|

530

|

Interest Expense

|

79

|

|

|

540

|

Supplies Expense

|

25

|

|

|

545

|

Insurance Expense

|

100

|

|

|

551

|

Depreciation Expense–Equipment

|

35

|

|

|

556

|

Depreciation Expense–Vehicles

|

200

|

|

|

|

$26,514

|

$26,514

|