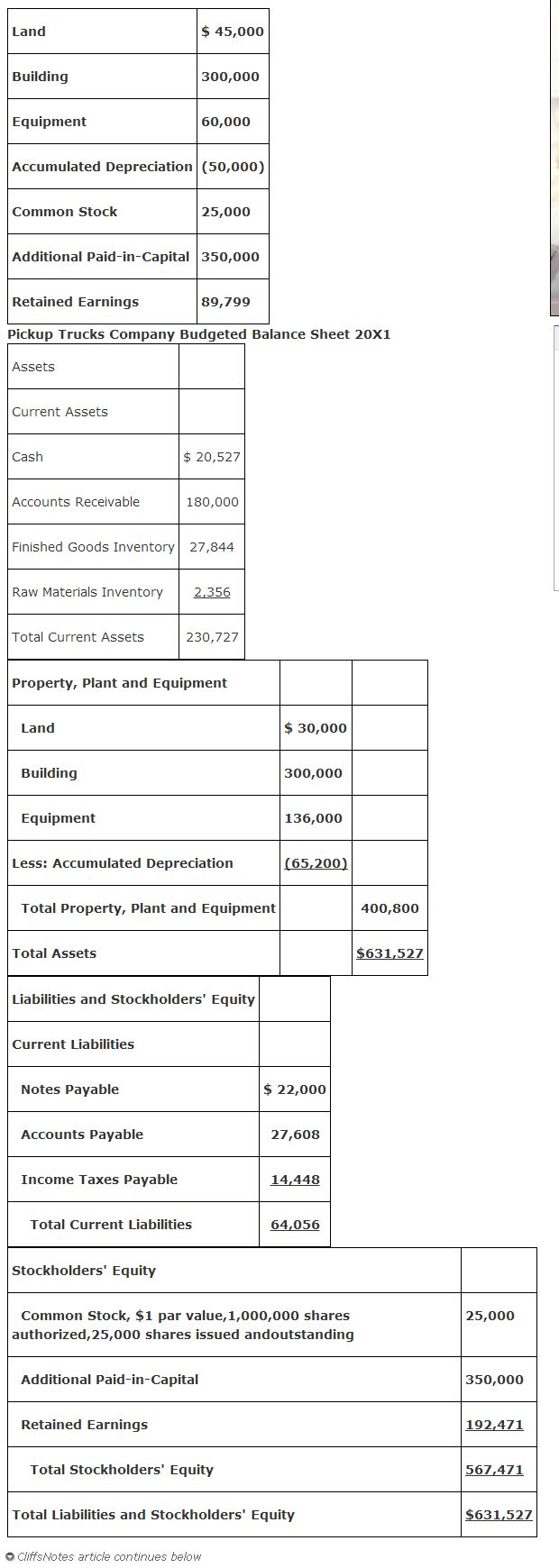

The budgeted or pro forma balance sheet projects the financial position of the company as of the end of the year. It is prepared by adjusting the beginning balances of long‐term asset, liability, and stockholders' equity accounts for expected activity during the budgeted period, and identifying balances in current asset and liability accounts at the end of the period. The beginning balances for the long‐term assets and stockholders' equity accounts are shown in the following table. The Pickup Trucks Company does not have any long‐term liabilities.

- Cash: Ending balance per the cash budget.

- Accounts receivable: 30% of fourth quarter sales ($600,000 × 30%).

- Finished goods inventory: 2,475 units (15% of next quarter's sales of 16,500) times $11.25 per unit cost. See production budget and cost of goods sold calculation for further information.

- Raw materials inventory: Materials for 1,683 units (10% of next quarter's production of 16,830 units) times $1.40 per unit cost of materials. See direct materials budget and cash budget for units and costs.

- Land: Sale of land with a cost of $15,000 (per cash budget information) deducted from beginning balance of $45,000.

- Building: No activity during the year.

- Equipment: Beginning balance of $60,000 plus purchases totaling $76,000.

- Accumulated depreciation: Beginning balance of $50,000 plus $15,200 additional depreciation per the manufacturing overhead budget.

- Notes payable: $72,000 in borrowings during the year minus $50,000 principal repayments per the cash budget.

- Accounts payable: 40% of fourth quarter purchases ($69,021 × 40%). See cash payments for raw materials in cash budget and its calculation spread sheet.

- Income taxes payable: Balance owed for current year taxes. Difference between estimated taxes paid (per cash budget for quarters two, three, and four) and the expense per budgeted income statement. The company did not make a payment of its 20X1 taxes in quarter one of 20X0; the payment in the cash budget quarter one is for 20X0 taxes.

- Common stock: No stock activity during the year.

- Additional paid‐in‐capital: No stock activity during the year.

- Retained earnings: Beginning balance $89,799 plus net income for the year of $102,672 per the budgeted income statement. Dividends were not declared and paid, and therefore none are deducted.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|