Merchandising Company Budgets

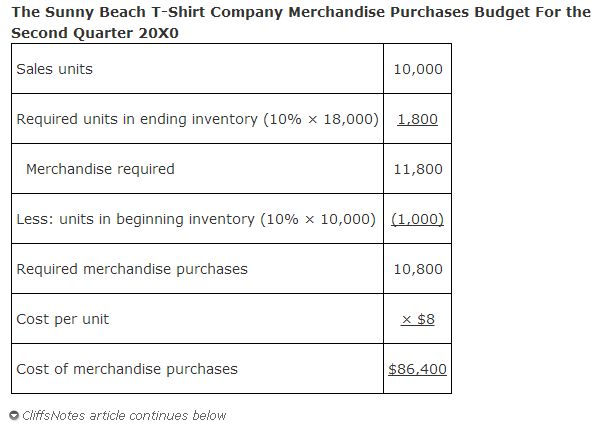

In a merchandising company, the production budget and the three manufacturing budgets—direct materials, direct labor, and manufacturing overhead—are replaced with the merchandise purchases budget. This budget is prepared using the same three components as the production budget—sales, required ending merchandise inventory, and beginning merchandise inventory. As with the production budget, the required ending inventory is added to the expected sales to determine total amount of merchandise needed, and beginning inventory is subtracted from the total to determine the amount of inventory that needs to be purchased. The number of units is multiplied by cost of the merchandise to complete the merchandise purchases budget. For example, assume The Sunny Beach T‐Shirt Company plans to sell 25,000 T‐shirts during quarter one, 10,000 during quarter two, 18,000 during quarter three, and 7,500 during quarter four. Given the timing of shipments, it maintains an inventory at the end of each quarter equal to 10% of the next quarter's sales. At a cost of $8 per T‐shirt, the company's second quarter merchandise purchases budget is $86,400.

The remaining budgets of a merchandising company (sales, selling expenses, general and administrative expenses, capital expenditures, cash, income statement, and balance sheet) are the same as those discussed for a manufacturing company.

|

|

|

|

|