The fundamental principle of the classical theory is that the economy is self‐regulating. Classical economists maintain that the economy is always capable of achieving the natural level of real GDP or output, which is the level of real GDP that is obtained when the economy's resources are fully employed. While circumstances arise from time to time that cause the economy to fall below or to exceed the natural level of real GDP, self‐adjustment mechanisms exist within the market system that work to bring the economy back to the natural level of real GDP. The classical doctrine—that the economy is always at or near the natural level of real GDP—is based on two firmly held beliefs: Say's Law and the belief that prices, wages, and interest rates are flexible.

Say's Law. According to Say's Law, when an economy produces a certain level of real GDP, it also generates the income needed to purchase that level of real GDP. In other words, the economy is always capable of demanding all of the output that its workers and firms choose to produce. Hence, the economy is always capable of achieving the natural level of real GDP.

The achievement of the natural level of real GDP is not as simple as Say's Law would seem to suggest. While it is true that the income obtained from producing a certain level of real GDP must be sufficient to purchase that level of real GDP, there is no guarantee that all of this income will be spent. Some of this income will be saved. Income that is saved is not used to purchase consumption goods and services, implying that the demand for these goods and services will be less than the supply. If aggregate demand falls below aggregate supply due to aggregate saving, suppliers will cut back on their production and reduce the number of resources that they employ. When employment of the economy's resources falls below the full employment level, the equilibrium level of real GDP also falls below its natural level. Consequently, the economy may not achieve the natural level of real GDP if there is aggregate saving. The classical theorists' response is that the funds from aggregate saving are eventually borrowed and turned into investment expenditures, which are a component of real GDP. Hence, aggregate saving need not lead to a reduction in real GDP.

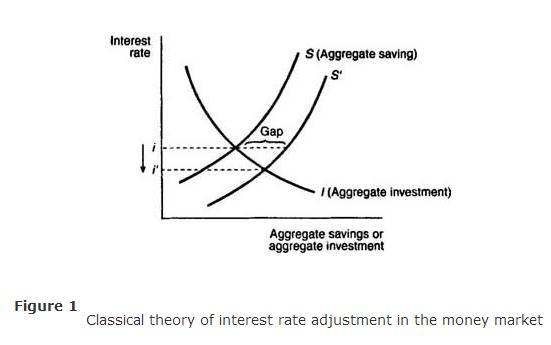

Consider, however, what happens when the funds from aggregate saving exceed the needs of all borrowers in the economy. In this situation, real GDP will fall below its natural level because investment expenditures will be less than the level of aggregate saving. This situation is illustrated in Figure .

Aggregate saving, represented by the curve S, is an upward‐sloping function of the interest rate; as the interest rate rises, the economy tends to save more. Aggregate investment, represented by the curve I, is a downward‐sloping function of the interest rate; as the interest rate rises, the cost of borrowing increases and investment expenditures decline. Initially, aggregate saving and investment are equivalent at the interest rate, i. If aggregate saving were to increase, causing the S curve to shift to the right to S′, then at the same interest rate i, a gap emerges between investment and savings. Aggregate investment will be lower than aggregate saving, implying that equilibrium real GDP will be below its natural level.

Flexible interest rates, wages, and prices. Classical economists believe that under these circumstances, the interest rate will fall, causing investors to demand more of the available savings. In fact, the interest rate will fall far enough—from i to i′ in Figure —to make the supply of funds from aggregate saving equal to the demand for funds by all investors. Hence, an increase in savings will lead to an increase in investment expenditures through a reduction of the interest rate, and the economy will always return to the natural level of real GDP. The flexibility of the interest rate as well as other prices is the self‐adjusting mechanism of the classical theory that ensures that real GDP is always at its natural level. The flexibility of the interest rate keeps the money market, or the market for loanable funds, in equilibrium all the time and thus prevents real GDP from falling below its natural level.

Similarly, flexibility of the wage rate keeps the labor market, or the market for workers, in equilibrium all the time. If the supply of workers exceeds firms' demand for workers, then wages paid to workers will fall so as to ensure that the work force is fully employed. Classical economists believe that any unemployment that occurs in the labor market or in other resource markets should be considered voluntary unemployment. Voluntarily unemployed workers are unemployed because they refuse to accept lower wages. If they would only accept lower wages, firms would be eager to employ them.

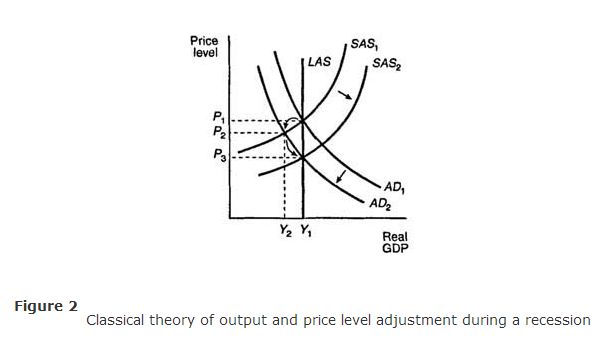

Graphical illustration of the classical theory as it relates to a decrease in aggregate demand. Figure considers a decrease in aggregate demand from AD 1 to AD 2.

The immediate, short‐run effect is that the economy moves down along the SAS curve labeled SAS 1, causing the equilibrium price level to fall from P 1 to P 2, and equilibrium real GDP to fall below its natural level of Y 1 to Y 2. If real GDP falls below its natural level, the economy's workers and resources are not being fully employed. When there are unemployed resources, the classical theory predicts that the wages paid to these resources will fall. With the fall in wages, suppliers will be able to supply more goods at lower cost, causing the SAS curve to shift to the right from SAS 1 to SAS 2. The end result is that the equilibrium price level falls to P 3, but the economy returns to the natural level of real GDP.