There are several definitions of the supply of money. M1 is narrowest and most commonly used. It includes all currency (notes and coins) in circulation, all checkable deposits held at banks (bank money), and all traveler's checks. A somewhat broader measure of the supply of money is M2, which includes all of M1 plus savings and time deposits held at banks. An even broader measure of the money supply is M3, which includes all of M2 plus large denomination, long‐term time deposits—for example, certificates of deposit (CDs) in amounts over $100,000. Most discussions of the money supply, however, are in terms of the M1 definition of the money supply.

Banking business. In order to understand the factors that determine the supply of money, one must first understand the role of the banking sector in the money‐creation process. Banks perform two crucial functions. First, they receive funds from depositors and, in return, provide these depositors with a checkable source of funds or with interest payments. Second, they use the funds that they receive from depositors to make loans to borrowers; that is, they serve as intermediaries in the borrowing and lending process.

When banks receive deposits, they do not keep all of these deposits on hand because they know that depositors will not demand all of these deposits at once. Instead, banks keep only a fraction of the deposits that they receive. The deposits that banks keep on hand are known as the banks' reserves. When depositors withdraw deposits, they are paid out of the banks' reserves. The reserve requirement is the fraction of deposits set aside for withdrawal purposes. The reserve requirement is determined by the nation's banking authority, a government agency known as the central bank. Deposits that banks are not required to set aside as reserves can be lent to borrowers, in the form of loans. Banks earn profits by borrowing funds from depositors at zero or low rates of interest and using these funds to make loans at higher rates of interest.

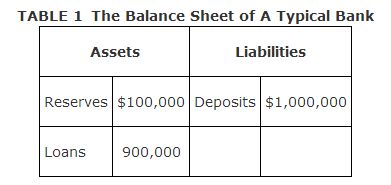

A balance sheet for a typical bank is given in Table . The balance sheet summarizes the bank's assets and liabilities. Assets are valuable items that the bank owns and consist primarily of the bank's reserves and loans. Liabilities are valuable items that the bank owes to others and consist primarily of the bank's deposit liabilities to its depositors. In Table , the bank's assets (reserves and loans) total $1 million. The bank's liabilities (deposits) total $1 million. A banking firm's assets must always equal its liabilities.

You can infer from Table that the reserve requirement in this example is 10%.

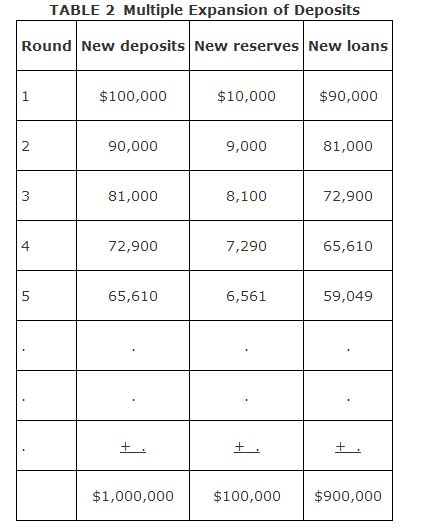

How banks create money. Consider what happens when the same bank receives a $100,000 deposit from one of its depositors. The bank is required to set aside 10% of this deposit, or $10,000, as reserves. It then lends out its excess reserves—in this case, the remaining $90,000 of the initial deposit. Suppose, for the sake of simplicity, that all borrowers redeposit their loans into the same bank. The bank thus receives $90,000 in new deposits of which it sets $9,000 aside as reserves and lends out all of its excess reserves. Suppose again that all borrowers redeposit their loans in the same bank, that the bank sets aside a portion of these deposits, and that the bank then lends out the remainder, which is again redeposited in the bank and so on and so on. This repeated chain of events is summarized in Table .

If one were to follow this multiple deposit expansion process to its completion, the end result would be that the bank's deposits would increase by $1 million, its loans would increase by $900,000, and its reserves would increase by $100,000, all due to the initial deposit of $100,000.

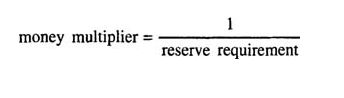

Money multiplier. The amount by which bank deposits expand in response to an increase in excess reserves is found through the use of the money multiplier, which is given by the formula

In the example of deposit expansion found in Table , the reserve requirement is 10%; so, the money multiplier in this case is (1/.10) = 10. The excess reserves resulting from the initial deposit of $100,000 are $90,000. Multiplying $90,000 by the money multiplier, 10, yields $900,000, which is the amount of additional deposits created by the banking system as the result of the initial $100,000 deposit.

In reality, loan recipients do not deposit all of their loan funds into a bank. More typically, they hold a fraction of their loan funds as currency. If some loan funds are held as currency, then there is a leakage of money out of the banking system. In this case, the money multiplier will still be greater than 1, but it will be less than the inverse of the reserve requirement.

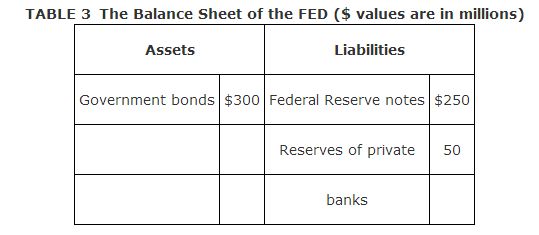

Central banking and the supply of money. A portion of each nation's money supply ( M1) is controlled by a government agency known as the central bank. The central bank is unique in that it is the only bank that can issue currency. The U.S. central bank is called the Federal Reserve Bank but is frequently referred to as “the Fed.” The Fed issues all U.S. dollar bills, known as Federal Reserve Notes. Thus, the Fed has control over the supply of the U.S. currency. The Fed also has control over the private bank reserves that banks entrust to the Fed. Banks hold a portion of their required reserves with the Fed because the Fed acts as a clearing house for all sorts of transactions between banks—for example, the processing of all checks.

The Fed's liabilities therefore consist of all Federal Reserve Notes in circulation plus all private bank deposits held at the Fed as reserves On the asset side, the Fed owns a large amount of government debt in the form of U.S. government bonds. These bonds have been issued by the U.S. Treasury to pay for current and past government deficits. A simplified example of the Fed's balance sheet is provided in Table . Note that the Fed's total liabilities are equal to its total assets.

The Fed's control over the money supply stems from its ability to change the composition of its balance sheet. For example, the Fed may decide to purchase additional government bonds on the open market from bondholders or private banks. This type of action is referred to as an open market operation by the Fed. In exchange for these government bonds, the Fed increases the reserves of private banks by the amount of the purchase. Banks, in turn, lend out their excess reserves and initiate the multiple deposit expansion process discussed above. Thus, when the Fed buys U.S. government bonds on the open market, it increases the supply of money by increasing bank reserves and inducing an expansion in the amount of deposits. Similarly, when the Fed sells some of its stock of U.S. government bonds to bondholders or private banks, the Fed compensates itself for the sale by reducing the reserves of private banks. The sale of government bonds by the Fed reduces the supply of money by reducing the reserves available to private banks and thereby decreasing the amount of deposit expansion that is possible.

The Fed can also control the supply of money by its choice of the reserve requirement. Recall that the money multiplier is the reciprocal of the reserve requirement. If the Fed increases the reserve requirement, the money multiplier decreases, implying that deposit creation and the money supply are reduced. If the Fed decreases the reserve requirement, the money multiplier increases, causing both the creation of deposits and the money supply to expand further.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|