Economic analysis is marginal analysis. In marginal analysis, one examines the consequences of adding to or subtracting from the current state of affairs. Consider, for example, an employer's decision to hire a new worker. The employer must determine the marginal benefit of hiring the additional worker as well as the marginal cost. The marginal benefit of hiring the worker is the value of the additional goods or services that the new worker could produce. The marginal cost is the additional wages the employer will have to pay the new worker. An economic analysis of the decision to hire the new worker involves weighing the marginal benefits against the marginal costs. If the marginal benefits are greater than the marginal costs, then it makes sense for the employer to hire the worker. If not, then the new worker should not be hired.

Ceteris paribus assumption. In performing economic analysis, it is sometimes difficult to separate out the effects of different factors on decisions or outcomes. For example, the decision of students to attend college may depend on a number of factors, including income, the tuition charged, or the market value of a college degree. The effect of an increase in tuition on college enrollment may not be immediately apparent because student incomes or the market value of a college degree may be changing along with the increase in tuition. To conduct a proper economic analysis of the effect of a rise in tuition on college enrollment requires that all other factors affecting the decision to attend college be held constant. The assumption of ceteris paribus, which is Latin for “all else held constant,” is frequently invoked in economic analysis. The phrase ceteris paribus conveys the assumption that only one of many factors is being examined. For example, if an increase in tuition led to a decrease in college enrollment taking into account all other factors such as changes in student incomes or in the market value of a college degree, one could summarize this finding with the statement: an increase in tuition reduces college enrollment, ceteris paribus.

Efficient production and the production possibilities frontier. In addition to the ceteris paribus assumption, economic analysis is often carried out under the assumption of efficient production. According to the efficient production assumption, the economy is always using its resources and technology to produce the maximum number of goods possible.

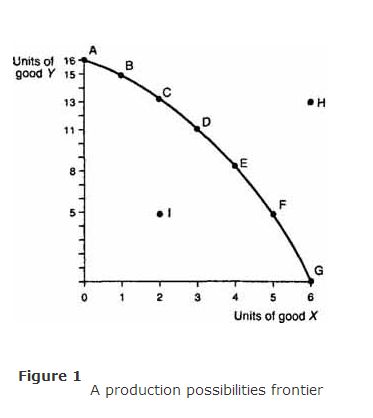

The efficient production assumption is frequently associated with the production possibilities frontier (PPF), a graphical device that is used for economic analysis of production decisions. The PPF measures the quantity of two goods that an economy is capable of producing with its currently available resources and technology. While economies typically produce more than two goods, the graphical analysis of the PPF is made easier by restricting the production possibilities of the economy to just two goods.

Figure depicts a PPF for an economy that is producing the goods X and Y. The PPF is the curved line through points A, B, C, D, E, F, and G. It represents the maximum possible quantities of goods X and Y that the economy is capable of producing and therefore symbolizes the efficient production assumption. The quantity of good X produced is measured on the horizontal axis, while the quantity of good Y produced is measured on the vertical axis. At point A on the PPF, the economy is using all of its resources to produce 16 units of good Y and 0 units of good X. Moving down along the PPF to the right of point A, fewer units of Y are produced, and more and more units of X are produced. At point B, the economy is producing 15 units of Y and 1 unit of X; at point C, the economy is producing 13 units of Y and 2 units of X, and so on. When the economy is producing at point G, it is putting all of its resources into production of good X—6 units of good X and 0 units of good Y. Points that lie in the interior of the curved PPF, such as point I, represent quantities of goods X and Y that are less than the maximum quantities the economy is capable of producing and are therefore considered inefficient production points. Under the efficient production assumption, production quantities such as point I can be excluded from any economic analysis. Because the PPF curve represents the maximum possible quantities of goods X and Y that the economy is capable of producing, points that lie beyond the PPF, such as point H, represent unattainable production points and can also be ruled out.

The bowed‐out, concave shape of the PPF is due to the presumption that the economy's resources are not equally well suited to the production of both goods X and Y. For example, some resources may not be very useful in producing good X but are very useful in producing good Y. If the economy were initially using all of its resources to produce 6 units of X—point G on the PPF—but then decided to produce 1 less unit of good X—5 units of X—some of the resources that are better suited to producing good Y would be released with the result that 5 units of good Y could now be produced—point F on the PPF. If the economy decided to produce only 4 units of good X, then even more resources would be released, and 3 more units of good Y, for a total of 8 units of good Y, could now be produced—point E on the PPF.

A special case arises when the resources used to produce good Y are equally well suited for the production of good X. In this case, the PPF would not be curved outward. Instead, the PPF would simply be a straight line connecting the points where the economy is using all of its resources to produce good Y (point A) and where the economy is using all of its resources to produce good X (point G).

It is important to note that the PPF drawn in Figure depicts production possibilities for fixed resources and fixed technology. If the amount of resources available to produce goods X and Y were to increase as a result of economic growth, then the PPF curve would shift outward, to the right, implying that the economy could produce greater quantities of both goods X and Y. The same holds true when improvements in technology allow for more efficient use of available resources; the PPF will shift outward, to the right. Production points such as point H may then become attainable.

Opportunity cost. In addition to displaying the economy's efficient production possibilities, the PPF is also used to illustrate an important concept in economic analysis called opportunity cost. The opportunity cost of a decision or choice that one makes is the value of the highest valued alternative that could have been chosen but was instead forgone. For example, suppose that one is faced with several ways of spending an evening at home. The choice made is to study economics (perhaps because there is an economics test tomorrow). The opportunity cost of this choice is the value of the highest valued alternative to the time spent studying economics. While there may be many alternatives to studying economics—watching television, reading a novel, talking on the telephone—there is only one alternative that has highest value. In this example, the alternative with highest value depends on one's own preferences. The value of the highest valued alternative—say, for example, reading a novel—would be considered the opportunity cost of studying economics.

The concept of opportunity cost also applies to production decisions. Returning to the PPF in Figure , suppose that the economy is initially at point C, producing 2 units of good X and 13 units of good Y. Consider what happens when the economy desires another unit of good X and so changes its production from point C on the PPF to point D. The opportunity cost of the additional unit of good X is the 2 units of good Y (13 units of Y ‐ 11 units of Y) that are forgone in moving from point C to point D. In the case of the PPF, where there are only two goods, the highest valued alternative to good X is good Y and vice versa.

Now, suppose that the economy desires yet another unit of good X and so changes its production from point D on the PPF to point E. The opportunity cost of this additional unit of good X is now 3 units of good Y (11 units of Y ‐ 8 units of Y). In this example, the opportunity cost of producing 1 more unit of good X increases as more of good X is produced. The reason is that some of the resources used to produce good Y are not as well suited to producing good X. (You should recall that this is the same reason for the bowed‐out, concave shape of the PPF.) Consequently, as more and more of the economy's resources are devoted to producing good X, the opportunity cost of good X, as measured in units of good Y forgone, will be increasing. This phenomenon is referred to as the law of increasing opportunity cost.

Common pitfalls in economic analysis. There are two “pitfalls” that should be avoided when conducting economic analysis: the fallacy of composition and the false‐cause fallacy. The fallacy of composition is the belief that if one individual or firm benefits from some action, all individuals or all firms will benefit from the same action. While this may in fact be the case, it is not necessarily so. For example, suppose an airline decides to lower the fares it charges on all of its routes. The airline expects to benefit from the fare reduction because it believes the lower fares will attract customers away from other airlines. If, however, the other airlines follow suit and lower their airfares by the same amount, then it is not necessarily true that all airlines will be better off; while more people may choose to fly, each airline will receive less money per passenger, and each airline's market share is unlikely to change. Hence, the profits of all airlines could fall.

The false‐cause fallacy often arises in economic analysis of two correlated actions or events. When one observes that two actions or events seem to be correlated, it is often tempting to conclude that one event has caused the other. But by doing so, one may be committing the false‐cause fallacy, which is the simple fact that correlation does not imply causation. For example, suppose that new‐car prices have steadily increased over some period of time and that new‐car sales have also increased over this same period. One might then conclude that an increase in the price of new cars causes an increase in new‐car sales. This false conclusion is an example of the false‐cause fallacy; new‐car prices and new‐car sales may be positively correlated, but that correlation does not imply that there is any causation between the two. In order to explain why both events are taking place simultaneously, one may have to look at other factors—for example, rising consumer incomes, inflation, or rising producer costs.